After participating in the formation of the Gecina-Eurosic group (Europe's leading office property company) in 2017 by selling its Eurosic stake to Gecina, Batipart redeployed its real estate activities in Europe by creating a single management platform: Batipart Immo Europe ("BIE"). This redeployment was accompanied by diversification, supported by the acquisition of assets of Eurosic portfolio in the leisure and healthcare sectors, followed by regional offices in 2018.

In 2021, BIE diversified its investments by disposing of its healthcare portfolio and part of its office portfolio and by reducing its exposure to leisure assets, while at the same time, stepping up its investments in housing (particularly co-living assets, with the acquisition of a stake in Urban Campus) and retail (acquisition of retail parks, shopping arcades, etc.).

Working alongside long-standing partners, BIE develops and manages a range of investment vehicles in Europe, focusing its strategy on two complementary areas: yield and value creation.

Key figures

Assets Under Management

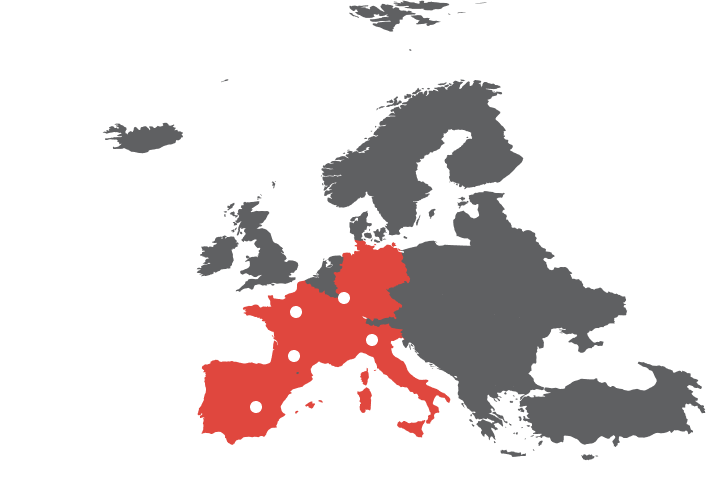

Presence in 7 European countries

Management Teams

Yield Strategy

Batipart supports its tenants, major leisure operators, in their development in order to create value and strengthen their long-term future in Europe.

The portfolio features long leases (firm 10+ year terms) secured with market-leading tenants such as Club Med, Pierre & Vacances, Center Parcs and B&B Hotels.

The office portfolio is concentrated in a several major regional cities (e.g. Nantes, Toulouse, Montpellier, Marseille, Nice) and offers very good rental and territorial diversification: this diversification contributes significantly to the portfolio resilience.

Batipart is embarking on a new key stage in its development with the creation of a property investment vehicle for hotels.

The first step took place in 2019 with the acquisition of six hotels (around 1,000 rooms), Novotel, Sofitel and Mama Shelter in Luxembourg (making Batipart the leader in the 4* and 5* hotel market), for an investment of over €400m.

Batipart has structured a pan-European portfolio of specialised retail assets. The portfolio currently comprises 57 assets in four European countries (France, Spain, Italy and Portugal) and represents a total surface area of over 462,000 m².

It is fully let to the Leroy Merlin, Tecnoman and Carrefour brands, and secured by long-term leases.

Batipart is stepping up investment in housing (particularly in co-living properties in France and Spain by acquiring a stake in Urban Campus).

Value Creation Strategy

Batipart develops and promotes office space, mainly in Paris and its inner suburbs.

The strategy consists of controlling the entire value chain of a development project: from sourcing and acquisition (land consolidation, purchase of buildings and search for additional building land), through to the structuring of operations, administrative authorisations, design and construction, to the letting of buildings and finally their resale.

Equity investment in listed property companies in Europe, offering diversified exposure to the listed property sector in terms of underlying products and enabling investors to benefit from the attractiveness of specific situations depending on market volatility.

The variety and depth of the listed property sector in Europe enable to select buoyant markets, quality assets and the right management teams. By analysing the sector and companies from both a financial and operational perspective, the aim is to identify attractive entry prices.